Last week we saw a strong rebound in the European markets, with a marked outperformance of the value style. What caused this rebound? Is it sustainable?

Here are some answers.

A massive underperformance of value stocks over the last several years, even more significant in 2020

In a context of weak growth and low or even negative interest rates seen in recent years, investors favoured so-called growth stocks, which provided a certain visibility on their results and preserved return.

The performance gap between “growth” and “value”, which was already significant at the beginning of the year (value underperformed by 13.5% in 2019), widened further in the Eurozone to reach 16% since the beginning of the year (as of end of May). Indeed, during the global health crisis, cyclical and financial stocks recorded losses of up to 60%, pricing in a sharp recession, while defensive growth stocks, which were already highly valued, held up well.

At the end of May, the valuation and performance gaps between these two styles were at their peak, well above the levels observed during previous crises (the TMT bubble or the 2008 great financial crisis). The violent shift recorded in recent days therefore partially corrects the excesses seen in previous months, but is still far from offsetting the accumulated underperformance.

This shift has been supported by several factors:

- Fiscal policy (the level of fiscal stimulus is unprecedented) and monetary policy (financing terms have never been so favourable).

- The proposal for a Franco-German recovery plan financed by joint debt, which reduced fears of an “Italexit” and showed a willingness to consolidate cohesion at European level.

- A rebound of leading indicators (after hitting a all-time lows).

- And a technical consideration, namely the fact that only 9% of European funds have outperformed since 25 May, which shows that investors are still largely underweight on the value theme.

Lessons from the past: What are the drivers for a rebound in “value”?

If the underperformance is explained by a period of weak growth and particularly low interest rates, the scenario that is currently shaping up explains the current rebound:

- The support measures initiated will lead to a sustainable rebound in growth after the sharp correction in the first half of the year. This is already seen through an uptick in SMIs, which is favourable for cyclical stocks: for 2021, the market is forecasting strong growth in earnings per share for these stocks and is not waiting for favourable base comparisons to act on it. The rebound of these stocks is primarily due to an increase in valuation multiples ahead of that of earnings per share, as it was the case back in March 2009 for instance, albeit with an even lower starting point this time.

- The resilience of interest rates: amid the global health crisis, we could have imagined the Bund playing its safe haven role, which did not materialize. The ECB kept short rates negative, but the prospect of rising debt levels (even if monetised by the Central Bank) kept the German 10-year rate at around -30 basis points. However, the correlation between the value factor’s performance and the level of interest rates is high, and we witnessed an unusual gap.

Why would this shift last?

In addition to this recent rebound, which above all has been partially correcting the excessive underperformance of cyclical and financial stocks since the beginning of the health crisis, several elements, historically in favour of value, support a continuation of this shift:

- The continued rebound in macroeconomic data as mentioned above, showing a “V”-shaped recovery, will be the first element facilitating this rotation that has been set in motion.

- The second element obviously relates to the outlook on interest rates and the sustained steepening of the rate curve, which will also favour this rotation and mainly benefit financials.

- Monetary policy is likely to remain very accommodating, which will help keep short-term rates low, while very expansionary fiscal policies will raise levels of public debt to higher levels, which will lead to a deterioration in credit quality and could even push up long-term rates higher.

- Furthermore, some fundamental elements also indicate an increase in labour costs and inflation. On the one hand, the end of tax cuts and the rise in commodity prices will weigh on margins, and companies will probably have to transpose these higher costs into their prices to preserve their margins. On the other hand, the drive to relocate production chains, linked to the fragility of the supply model that was observed during the health crisis, is by nature inflationary.

Yield curve steepening episodes are generally associated with an outperformance of value stocks. These factors should help normalise rates and support the current shift that is being observed.

Nevertheless, several elements could upset this shift: a resurgence of the COVID-19 epidemic, a lack of progress in EU discussions on the Franco-German recovery plan or a return of Sino-American tensions ending in the reinstatement of tariffs (although the latter seems unlikely, with only a few months left until the US presidential elections).

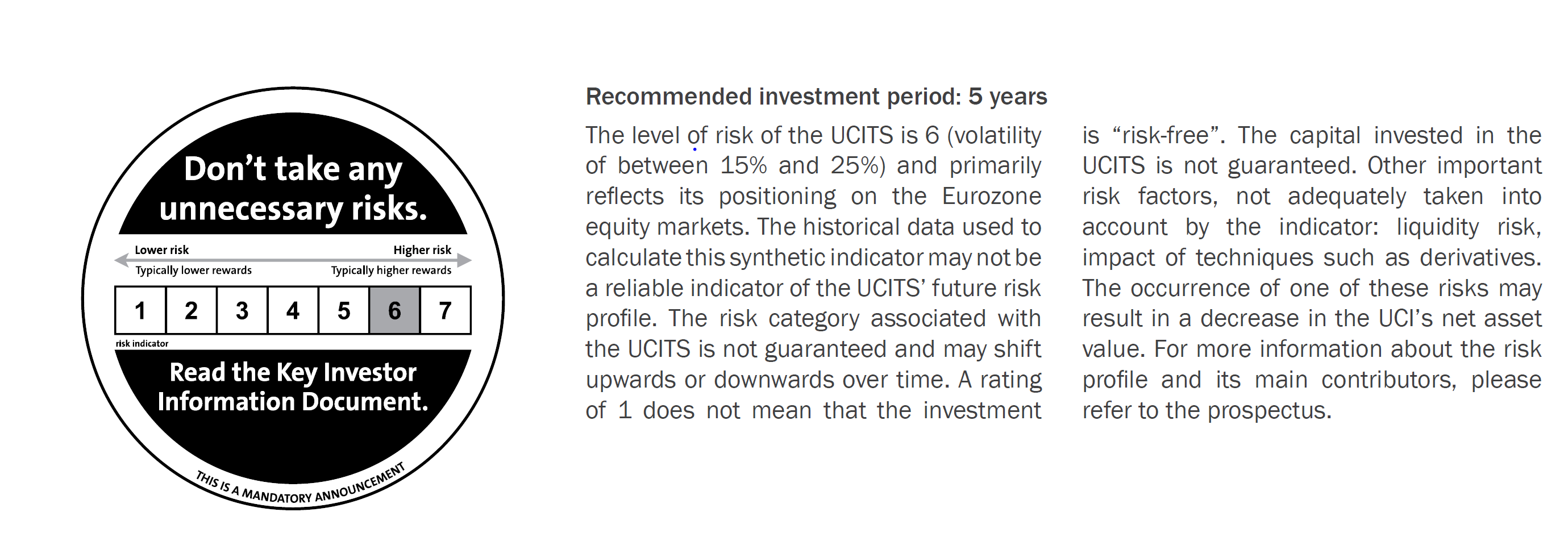

R-co conviction Equity Value Euro is taking full advantage of this shift in light of its positioning

- The fund is taking full advantage of this shift in light of its positioning.

- Since early June, the fund has outperformed its benchmark index by 6.4%, gaining 15.3% versus 8.9% for the Euro Stoxx dividends reinvested.

- It has benefited from the outperformance of cyclicals and financials, in particular through positions with healthy balance sheets that had been strengthened during the downturn and which, in our opinion, incorporated a scenario that was far too negative. These stocks staged a spectacular rebound since the beginning of the month: as an example, Airbus soared 44%, Société Générale 34%, BNP Paribas and PSA Groupe 22%.

- Although difficult to identify relevant valuation indicators based on 2020 earnings, which will be affected by the crisis, if we consider expected earnings for 2021, the fund’s valuation ratios remain very attractive: 2021 P/E stands at 10.2x and market capitalisation/net assets ratio at 0.8x.

- The underperformance remains significant, but the rebound is strong, and the particularly low starting point still leaves significant potential for catching up.

- The fund maintains a firm value positioning with a noticeable overweight in the cyclical (automotive, construction) and financial (banks) sectors, and an underweight in growth sectors. It is therefore positioned to benefit from the rotation that is currently coming into place.